BanyanTree Group employs a data driven approach to understanding economic conditions, monetary & fiscal policy, forcast analyses, demographic trends, rental rates, vacancy/occupancy data, absorption trends, replacement costs and supply/demand conditions, to select markets that exhibit superior growth potential.

We combine this information with intimate local knowledge and local operational experience to select, underwrite realistically, structure conservatively, and opportunistically acquire well located underperforming and undervalued assets

Upon acquisition the team implements a well-defined investment plan with disciplined and proactive asset management that evolves to reflect changing circumstances finding creative solutions to unforeseen or un-anticipated challenges

Current Acquisition Criteria

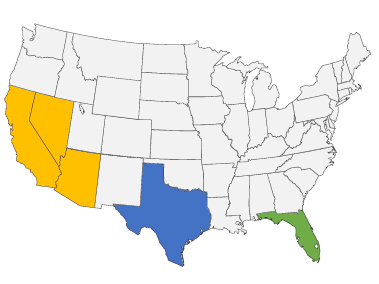

Current Acquisition CriteriaBanyanTree Group is focused on the acquisition of value add and opportunistic real estate assets that exhibit a potential of delivering superior risk adjusted returns through an appropriate balance of cash-flow and long term capital appreciation.

Multifamily Properties

Multifamily Properties